It provides guidance on the techniques for the measurement of cost, such as the standard cost method or retail method. It also outlines acceptable methods of determining cost, including specific identification, first-in-first-out and weighted average cost method.

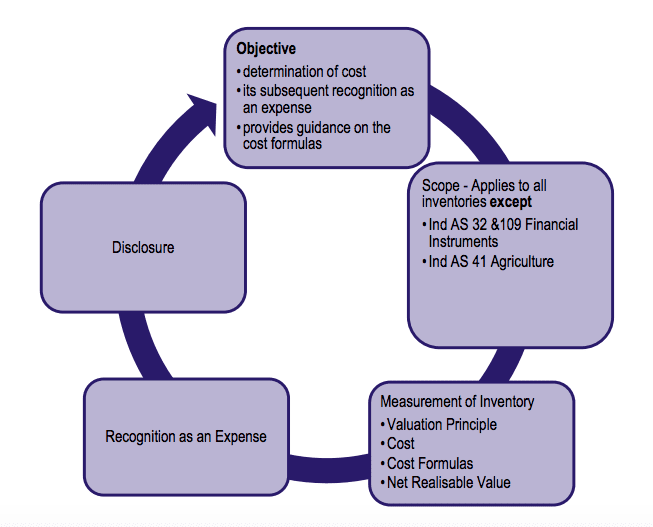

Indian Accounting Standard (IndAS 2)

Scope of IndAS 2

This Standard is applicable to all inventories, except:

a) financial instruments (to be accounted under Ind AS 32, Financial Instruments: Presentation and Ind AS 109, Financial Instruments);b) biological assets (i.e. living animals or plants) related to agricultural activity and agricultural produce at the point of harvest (to be accounted under Ind AS 41, Agriculture);

This Standard does not apply to the measurement of inventories held by:

a) producers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products, to the extent that they are measured at net realisable value in accordance with well-established practices in those industries.When such inventories are measured at net realisable value, changes in that value are recognised in profit or loss in the period of the changeb) commodity broker-traders who measure their inventories at fair value less costs to sell. When such inventories are measured at net realisable value/ fair value less costs to sell, changes in those values are to be recognised in profit or loss in the period of the change.

Inventory

a) held for sale in the ordinary course of business; (Finished Goods)b) in the process of production for such sale; or (Work in progress)c) in the form of materials or supplies to be consumed in the production process or in the rendering of services. (Raw material)

Inventories encompass of:

a) goods purchased and held for resale (e.g. merchandise purchased by a retailer and held for resale, or land and other property held for resale);b) finished goods produced, or work in progress being produced, by the entity; and includesc) materials and supplies awaiting use in the production process.

Costs incurred to fulfill a contract with a customer that do not give rise to inventories are accounted as per Ind AS 115. Illustration 1 As per Ind AS 2, inventories include ‘materials and supplies awaiting use in the production process’. Whether packing material and publicity material are covered by the term ‘materials and supplies awaiting use in the production process’. Solution While the primary packing material may be included within the scope of the term ‘materials and supplies awaiting use in the production process’ but the secondary packing material and publicity material cannot be so included, as these are selling costs which are required to be excluded as per Ind AS 2. For this purpose, the primary packing material is one which is essential to bring an item of inventory to its saleable condition, for example, bottles, cans etc., in case of food and beverages industry. Other packing material required for transporting and forwarding the material will normally be in the nature of secondary packing material. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. Net realisable value refers to the net amount that an entity expects to realize from the sale of inventory in the ordinary course of business. Fair value reflects the price at which an orderly transaction to sell the same inventory in the principal (or most advantageous) market for that inventory would take place between market participants at the measurement date. The former is an entity-specific value; the latter is not. Net realisable value for inventories may not equal fair value less costs to sell. 4) Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (Ind AS 113, Fair Value Measurement.)

Cost of Inventories

The cost of inventories shall be assigned by using the first-in first-out (FIFO) or weighted average cost formula. An entity shall use the same cost formula for all inventories having a similar nature and use to the entity. Cost of Inventories comprises:

a) all costs of purchase;b) costs of conversion; andc) other costs incurred in bringing the inventories to their present location and condition.

- Cost of Purchase

a) the purchase price,b) import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities),c) transport, handling andd) other costs directly attributable to the acquisition of finished goods, materials and services.

Any trade discounts, rebates and other similar items are deducted in determining the costs of purchase of inventory. EXAMPLE: FIFO AND WEIGHTED AVERAGE COST METHOD

2) Cost of Conversion

The costs of conversion of inventories include costs directly related to the units of production, such as: (Price of Last purchase taken for valuation) (Rate applicable to valuation = Total Purchase Cost/Total Qty Purchase)

a) direct material, direct labour and other direct costs; andb) a systematic allocation of fixed and variable production overheads that are incurred in converting materials into finished goods.Fixed production overheads are those indirect costs of production that remain relatively constant regardless of the volume of production, such as depreciation and maintenance of factory buildings, equipment and right-of-use assets used in the production process, and equipment, and the cost of factory management and administration.Allocation of fixed production overheads to the costs of conversion is based on the normal capacity of the production facilities. Normal capacity is the production expected to be achieved on average over a number of periods or seasons under normal circumstances, taking into account the loss of capacity resulting from planned maintenance. The actual level of production may be used if it approximates normal capacity.When production levels are abnormally low, unallocated overheads are recognised as an expense in the period in which they are incurred. In periods of abnormally high production, the amount of fixed overhead allocated to each unit of production is decreased so that inventories are not measured above cost.Variable production overheads are those indirect costs of production that vary directly, or nearly directly, with the volume of production, such as indirect materials and indirect labour. Variable production overheads are allocated to each unit of production on the basis of the actual use of the production facilities.

3) Other Costs

Included in the cost of inventory to the extent that they are incurred in bringing the inventories to their present location and conditions. If specifically identified to a particular product then should be included in the cost of that particular product.Financing cost, if inventory purchased on deferred payment method then the difference between normal price and price charged by vendor under credit terms shall be shown under finance expense as interest cost and therefore will not form part of inventory valuation.

Recognition as an Expense

- The amount of inventories recognised as an expense in the period will generally be:

a) carrying amount of the inventories sold in the period in which related revenue is recognised; andb) the amount of any write-down of inventories to net realisable value and all losses of inventories shall be recognised as an expense in the period the write-down or loss occurs; reduced by

the amount of any reversal in the period of any write-down of inventories, arising from an increase in net realisable value shall be recognized as a reduction in the amount of inventories recognised as an expense in the period in which the reversal occurs. 2) Some inventories may be allocated to other asset accounts, for example, inventory used as a component of self-constructed property, plant or equipment. Inventories allocated to another asset in this way are recognised as an expense during the useful life of that asset through charging of depreciation on that asset.

IndAS 115 Revenue from Contracts with CustomersInd AS 40 Investment PropertyComponent AccountingIFRS in India – Beginning of A New JourneyWhat is IASB, FASB, IFRS, Ind AS and US GAAP?

Circumstances under which inventories are write down to net realisable value

In case of damaged inventoriesInventory partially/ completely obsoleteIn case where finished goods in which raw material will be used is expected to be sold below cost of finished goods.

Reversal of written down of inventories

Separate disclosure should be given under notes to accounts for reversal of write down if realisable value of inventories increased above cost.

DISCLOSURE IN NOTES TO ACCOUNTS Under IndAS 2

Policies adopted in measuring inventories.Value of inventories in different head of inventories like Raw material, WIP, Finished goods and stores and tools.Written down of inventories in current year and their reversal.Inventories pledged as security.

Difference Between Ind AS 2 and AS 2